Feature release 11/24/2021: Improved Post payment from facility module and more!

Posted on November 24, 2021

Dear practitioner!

Do you know the difference between Write-Offs and Write-Downs? The difference is just a matter of degree. A write-down is performed in accounting to reduce the value of an asset to offset a loss or expense. A write-down becomes a write-off if the entire balance of the asset is eliminated and removed from the books altogether.

To make Write off more comfortable for you, you are welcome to use new EMSOW’s feature in the Post payment from facility window that makes posting a payment from a facility more flexible.

Below you can also find some updates that we made to EMSOW’s billing rules.

If you are not with EMSOW yet, you are welcome to book a FREE online demo here!

[#22781] Clinical laboratory travel allowance in billing and transportation rules

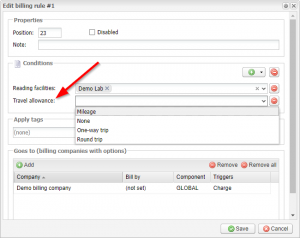

From now on, you can set the clinical laboratory travel allowance type as a condition in Billing Rules:

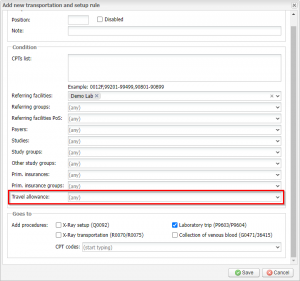

And in Transportation and Setup Rules:

[#22425] Write off remaining balance when posting a facility check

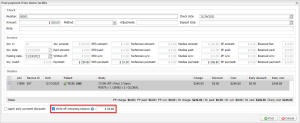

The latest release makes posting a payment from a facility more flexible: if the check amount is lower than the payment, you can now write off the difference, in whole or in part. To that end, we have added the Write off remaining balance checkbox to the Post payment from facility window:

Once you select the checkbox, the remaining balance amount will auto-populate into the respective field. You can change this amount or leave it as it is. The write-off will be applied proportionally to all services in the referring facility invoice.